Local Small Businesses Are Entitled

To Earmarked Federal Money

|

The Employee Retention Tax Credit (ERTC) Act is a tax credit available to eligible employers who have been significantly impacted by the COVID-19 pandemic. The ERTC was introduced in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was signed into law on March 27, 2020. The credit has since been extended and expanded by subsequent legislation, including the Consolidated Appropriations Act of 2021 (CAA) and the American Rescue Plan Act (ARPA).

The ERTC is designed to encourage employers to retain their employees during the pandemic by providing a refundable tax credit against payroll taxes. Eligible employers can claim a credit of up to 70% of an employee's qualified wages, up to a maximum credit of $7,000 per employee per quarter. The credit can be used to offset federal payroll taxes, including social security and Medicare taxes, and any excess credit can be refunded to the employer. Apply here: ERTC Express

To be eligible for the ERTC, an employer must meet certain criteria. The employer must have experienced a significant decline in gross receipts or been fully or partially suspended due to government orders related to the pandemic. For the first two quarters of 2021, the decline in gross receipts must be at least 20% compared to the same quarter in 2019. For the third and fourth quarters of 2021, the decline in gross receipts must be at least 10% compared to the same quarter in 2019.

Additionally, eligible employers must have fewer than 500 full-time employees. For the first two quarters of 2021, an eligible employer can claim the credit for all wages paid to an employee, up to a maximum of $10,000 per employee per quarter. For the third and fourth quarters of 2021, the maximum credit is increased to $12,000 per employee per quarter. Qualified wages include wages paid to an employee between March 13, 2020, and December 31, 2021. The credit can be claimed for wages paid to employees who are not working due to a government order related to the pandemic, as well as for wages paid to employees who are working but at a reduced level. The credit can also be claimed for health plan expenses paid on behalf of eligible employees. Find out how much you well be getting back, here: ERTC Express

It is important to note that employers cannot claim both the ERTC and the Paycheck Protection Program (PPP) loan. If an employer received a PPP loan, they may still be eligible for the ERTC for wages that are not paid for with PPP loan proceeds. In addition, if an employer claimed the ERTC in 2020, they may still be eligible to claim the credit in 2021, as long as they meet the eligibility requirements.

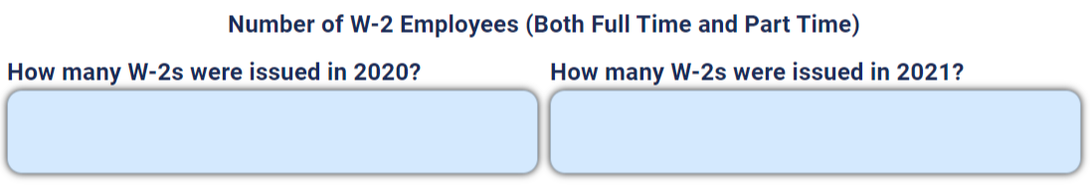

To claim the ERTC, eligible employers must report their qualified wages and the related credit on their quarterly employment tax returns (Form 941). Employers can reduce their federal employment tax deposits by the amount of the anticipated credit or request a refund of any excess credit. In conclusion, the Employee Retention Tax Credit Act is a tax credit available to eligible employers who have been significantly impacted by the COVID-19 pandemic. The credit is designed to encourage employers to retain their employees by providing a refundable tax credit against payroll taxes. To be eligible for the credit, employers must meet certain criteria, including a significant decline in gross receipts and fewer than 500 full-time employees. The credit can be claimed for wages paid to employees who are not working due to a government order related to the pandemic, as well as for wages paid to employees who are working but at a reduced level. Employers can claim the credit on their quarterly employment tax returns and use it to offset federal payroll taxes or request a refund of any excess credit. |

Does PPP Matter?No. Whether your business applied for Paycheck Protection Program entitlements or not, and whether your business was eligible for Paycheck Protection Program funds or not, your business may still qualify for more money through the Employee Retention Tax Credit act.

Apply Here

Potential Cash

There are two components to the Employee Retention Tax Credit Act.

Under the initial program, eligible businesses are entitled to up to $5,000 per employee. Under the revised plan, there is a potential of up to $21,000 per employee. Many employers receive $26,000 per worker. Learn MoreStart UpsStartups companies may be eligible for over $30,000.

Closed BusinessIf a business was closed for financial, labor, or government-caused complications, it may still be entitled to the Employee Retention Tax Credit Act benefits.

|

Government Handing Businesses Owed Money

9 Questions Determine Eligibility

High Quality

|

High Quality

|

Other Articles

- Combat Cholesterol, High Blood Pressure, Inflammation, and Diabetes … at the same time … with food?!

- Dowsing for Network Marketers

- WaterburyLife.com, 2024.02.22

- Kinesiology for Network Marketers

- WaterburyLife.com, 2024.02.22

- How to Love Yourself

- WaterburyLife.com, 2024.02.22

- Ultimate Guide to Joint Health

- LinkedIn, 2024.02.15

- Begin With God, Daily

- LinkedIn, 2024.02.14

- Unlock Your Path to Prosperity: Elevate Your Life With A Transformative Income

- LinkedIn, 2024.02.02

- Quick Guide To Foods And Best Practices For Reducing And Controlling Inflamation

- LinkedIn, 2024.01.23

- Attracting, Hiring, Training, and Retaining the Best Possible Employees for Small Businesses Part 2

- LinkedIn, 2023.04.03

- Importance, Difficulties, and Best Practices for Attracting, Hiring, Training, and Retaining the Highest Quality Employees

- LinkedIn, 2023.03.27

- How To Be A Captivating Speaker

- LinkedIn, 2023.03.10

- Creating Your Best Future Self Through a Can-Do Attitude, Positive Thinking, Deliberate Self-Talk, Affirmations, and Transcendentalism

- LinkedIn, 2023.01.19

- WaterburyLife.com; 2022.01.29

- How Camping Has Evolved in the Past 3 Years

- LinkedIn, 2023.01.17

- Getting Good Requires Fearlessness, 2023.01.13; LinkedIn

- LinkedIn, 2023.01.13

- How New Year's Resolutions Undermine Our Objectives and Goals

- LinkedIn, 2022.12.08

- Unlock Your Path to Prosperity: Elevate Your Life with a Transformative Income Opportunity

- Top 21 Concerns of Small Business Owners

- LinkedIn; WaterburyLife.com

- Small Businesses Solve Cash Flow Management Concerns Today

- Small Business Financial Management

- Attracting, Hiring, Training, and Retaining the Best Possible Employees for Small Businesses Part 1 - The Importance of Attracting, Hiring, Training, and Retaining the Best Possible Employees

- Attracting, Hiring, Training, and Retaining the Best Possible Employees for Small Businesses - Part 2

- Small Business Marketing and Advertising

- How Small Businesses Can Survive and Thrive Through Growth, Sudden Growth, and Growth During Highly-Uncertain Times

- How to be a Captivating Speaker

- Humor While Giving a Speech

- Why Trucker Crumbs and X-Caps Are Becoming Routine

- 10 Proven Strategies for Cutting Your Fuel Costs

- How Camping Has Evolved in the Past 3 Years

- Differences And Similarities Between A Psychic Medium, A Clairvoyant, An Empath, And An Astrologer

- Putting God First

- EPA-registered Product Boosts Fuel Economy

- Local Small Businesses Are Entitled To Earmarked Federal Money

- Despite What You May Have Heard or Experienced, This Can Work For You!

- MLMGateway; 04.02.2024

- Empowering Consumers and Retailers Alike: An Exploration of the Clubshop Network

- MLMGateway; 10.05.2023

- Why Chose LiveGood?

- MLMGateway; 03.05.2023

- Can This Be Your Direct Path To Success?

- MLMGateway; 03.05.2023

- We Got Friends

- MLMGateway; 26.04.2023

- Airfare, Car Rentals, Cruises, Hotels for less than any of the big guys!

- MLMGateway; 26.04.2023

- EPA-registered Product Boosts Fuel Economy

- MLMGateway; 02.02.2023