Staying Ahead of Inflation:

Smart Strategies for Financial Resilience

|

Staying Ahead of Inflation: Smart Strategies for Financial Resilience

In today's economic climate, many of us find ourselves struggling to keep pace with the relentless march of inflation. The purchasing power of our hard-earned money seems to dwindle with each passing year, leaving us feeling financially vulnerable. However, there are proactive steps we can take to not only weather the storm but potentially come out ahead. Let's explore some practical solutions to help you stay financially resilient in the face of rising costs. Understanding the Inflation Challenge Before diving into solutions, it's crucial to understand the scope of the problem. According to recent data from the U.S. Bureau of Labor Statistics, the Consumer Price Index has risen by 3.7% over the last 12 months. This means that, on average, what cost $100 a year ago now costs $103.70. While this may not seem significant in the short term, the cumulative effect over years can be substantial. |

1. Practical Solutions to Combat Inflation1. Smart Shopping Strategies

2. Earning Additional Income

3. Reducing Expenses

4. Building Long-Term Financial Resilience

- Use cashback apps and credit cards: Apps like Rakuten and credit cards with cashback rewards can help you earn money on purchases that you're already making.

- Price comparison tools:

- Compare prices on fuel (gasoline or diesel), Restaurants, Groceries, and much more, with UpSide.

- Utilize browser extensions like Honey or PriceGrabber to ensure you're getting the best deal on online purchases.

- Buy in bulk: For non-perishable items, buying in larger quantities can often lead to significant savings over time.

- However, avoid the trap of buying on price - concentrate on price per unit, and do not assume that the prices per unit on the shelves or on the website have been accurately calculated - do the math yourself.

2. Earning Additional Income

- Supplemental Income: Consider freelancing, tutoring, or driving for ride-sharing services to supplement your primary income.

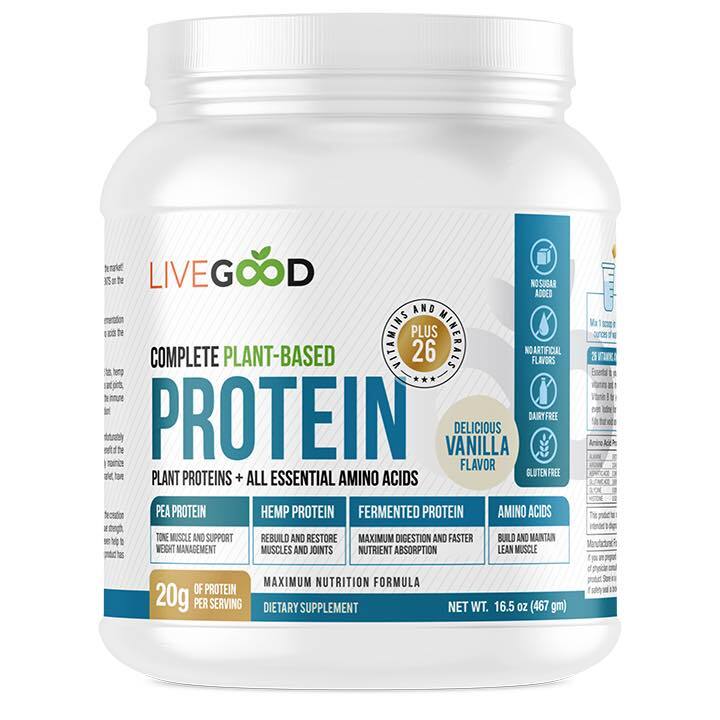

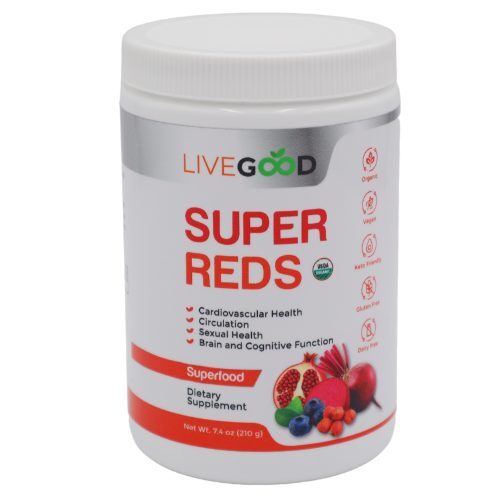

- Network Marketing, Multi-Level Marketing: Send me a message for much more information.

- Affiliate marketing, Click Marketing: If you have a blog or social media following, affiliate marketing can be a way to earn commissions on products you recommend.

- Invest in dividend-paying stocks:

- Always seek the advice of a qualitied, trustworthy licensed, experienced, educated, and up-to-date professionals

- While all investments carry risk, dividend stocks can provide a steady stream of income to help offset rising costs.

- Always seek the advice of a qualitied, trustworthy licensed, experienced, educated, and up-to-date professionals

3. Reducing Expenses

- Energy efficiency:

- Invest in energy-efficient appliances and smart home devices to reduce utility bills.

- Adhere to the manufacturer's suggestions for maximum fuel efficiency and appliance longevity

- Click here to find out if you can buy your electricity at lower rates.

- Click here to get better fuel efficiency and performance for your personal auto, big rig, farm equipment, and more.

- Invest in energy-efficient appliances and smart home devices to reduce utility bills.

- Cut unnecessary subscriptions: Review your monthly subscriptions and cancel those you don't use regularly.

- Negotiate bills:

- Many service providers are willing to offer discounts if you simply ask or threaten to switch to a competitor.

- Have a professional negotiate with your suppliers - click here for more information.

4. Building Long-Term Financial Resilience

- Invest in yourself: Continuously improve your skills to increase your earning potential.

- Diversify your income streams:

- Don't rely on a single source of income.

- Look for ways to create multiple revenue streams.

- Shorten your learning curve. Click here for information.

- Consider real estate:

- Always seek appropriate professional advice when considering a career change or other career choice

- Property values and rents tend to increase with inflation, making real estate a potential hedge against rising costs.

- Always seek appropriate professional advice when considering a career change or other career choice

|

Case Study:

The Power of Compound Savings Let's look at a hypothetical example of how these strategies can add up: Sarah implemented a combination of cashback apps, smart shopping, and energy-saving measures. She managed to save an average of $200 per month. Instead of spending this money, she invested it in a diversified portfolio of index funds and dividend-paying stocks. Assuming an average annual return of 7% (accounting for inflation), after 10 years, Sarah's initial savings grew to over $34,000. This not only helped her keep pace with inflation but put her significantly ahead financially. |

The Importance of Giving Back

While focusing on personal finances is crucial, it's equally important to remember the power of giving. Tithing or charitable giving can provide both spiritual fulfillment and potential tax benefits. Many find that the act of giving, even in small amounts, helps maintain a healthy perspective on money and can lead to unexpected blessings. This abundance mindset may likely result in a significantly stronger financial position than a scarcity mindset. Here’s an easy way for you to tithe, using Big Box Bank Bucks instead of your own money!

Conclusion

Staying ahead of inflation requires a multi-faceted approach. By combining smart shopping strategies, creating additional income streams, reducing expenses, and making informed investments, it's possible to not only keep pace with rising costs but to thrive financially. Remember, small actions taken consistently can lead to significant results over time.

As we navigate these challenging economic times, let's commit to being proactive in our financial decisions. By implementing even a few of these strategies, you can take meaningful steps towards financial resilience and peace of mind.

While focusing on personal finances is crucial, it's equally important to remember the power of giving. Tithing or charitable giving can provide both spiritual fulfillment and potential tax benefits. Many find that the act of giving, even in small amounts, helps maintain a healthy perspective on money and can lead to unexpected blessings. This abundance mindset may likely result in a significantly stronger financial position than a scarcity mindset. Here’s an easy way for you to tithe, using Big Box Bank Bucks instead of your own money!

Conclusion

Staying ahead of inflation requires a multi-faceted approach. By combining smart shopping strategies, creating additional income streams, reducing expenses, and making informed investments, it's possible to not only keep pace with rising costs but to thrive financially. Remember, small actions taken consistently can lead to significant results over time.

As we navigate these challenging economic times, let's commit to being proactive in our financial decisions. By implementing even a few of these strategies, you can take meaningful steps towards financial resilience and peace of mind.

What stratetgies have you found to be most effective in combating inflation?

The views and perspectives in this article are not necessarily consistent with the author nor the platform on which this article has been published or otherwise conveyed. The information provided in this article is for general informational purposes only and should not be considered as professional financial advice. The author is not a licensed financial advisor, and the strategies discussed may not be suitable for everyone. Investment involves risk, including the potential loss of principal. Past performance does not guarantee future results. The case study presented is hypothetical and for illustrative purposes only. Actual results may vary significantly. Readers are encouraged to conduct their own research and consult with qualified financial professionals before making any investment or financial decisions. The author and LinkedIn are not responsible for any actions taken based on the information presented in this article. The mention of specific products, apps, or services does not constitute an endorsement. The author may or may not have a financial relationship with the companies mentioned. Remember that financial circumstances are unique to each individual, and what works for one person may not work for another. Always consider your personal financial situation, goals, and risk tolerance when implementing any financial strategy.